property tax in france 2019

Property Tax in France Land TaxTaxe foncière. The total taxes paid during the house purchase in France may add up 20 to the property price.

Pin By Ariful 1234 On Good Inheritance Smoke Bomb Photography Europe

The French taxe foncière is an annual property ownership tax which is payable in October every year.

. 38 rows Todays map shows how European OECD countries rank on property taxes continuing our series on the component rankings of the 2019 International Tax Competitiveness Index Although an important element when measuring the neutrality and competitiveness of a countrys tax code property taxes account on average for less than 5. Largely speaking these taxes cover local services such as street cleaning waste. If youre selling land or property or have assets of more than 13 million there may be capital gains tax to consider too.

For income up to 26070 the rate remains taxed at 20. The former is paid by the landlord and the latter by the occupier whether thats a landlord or a tenant. Note that the proposed measures dont apply to second home owners in France.

Its important to keep in mind that this tax calculator is meant to be an estimation of your tax burdern and not a precise number. To be eligible your income must not exceed a certain threshold then you will benefit from a reduction of 30 in 2018 65 in 2019 and complete abolition by 2020. As a result of simultaneous changes to the liability for social charges since 2019 the combined rate of social charges and income tax on French sourced income of EEA non-residents is 275 down from 372 provided the income does not exceed the above threshold.

The main two taxes in France for property are the t axe foncière and the taxe dhabitation. As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2019 is 49 45 4. The specific deadline for.

It is separate to the taxe dhabitation which is paid by whoever occupies the property whether they are an owner or. About 20 tax on a 100 purchase. Once you buy a property in France whether built or not you automatically become liable for the land or property tax.

The taxe foncière is used to fund. Property prices per sqm in Paris. The Property tax is generally paid in October.

In France taxes are levied by the government and collected by the public administrations. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237. As from January 1 2019 a 10 percent tax rate applies to the net income derived from the licensing and sub-licensing of qualifying patents and to the net gains derived from the transfer to non-related entities of qualifying patents provided that they.

Initially set to start in 2018 France will introduce a pay-as-you-earn scheme for the collection of the income tax in January 2019. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. The VAT is a sales tax that applies to the purchase of most goods and services and must be collected and submitted by the merchant to the France governmental revenue department.

The assessment to get to net taxable wealth is complex and if you are likely to be liable then professional advice should be taken. There may be a slight differences. A wealth tax cap operates so that total taxes should not exceed 75 of income a complicated rule that only applies to residents.

From January 2019 the tax office will deduct a sum each month 15th day as a withholding tax on 2019 income. Email your questions to editors. Exact tax amount may vary for different items.

For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise. The tax is calculated annually by the public authorities according to the cadastral rental value of the property and the rate determined by the local authorities. The property tax on built lands taxe foncière is applied to properties built in.

Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. France Non-Residents Income Tax Tables in 2019. The two property taxes in France are the taxe foncière and the taxe dhabitation although the latter is gradually being phased out by 2020 for most households.

They include agents fees 5-8 notary fees 25-5 stamp duty. The current France VAT Value Added Tax is 2000. Income Tax Rates and Thresholds Annual Tax Rate.

This will be followed by a 65 per cent reduction in 2019 and a 100 per cent reduction in 2020. Key tax factors for efficient cross-border business and investment involving France. Rental and related investment income from France and taxable in France beyond this level is taxed at 30.

The taxe foncière is a tax paid by all property owners in France. You also have to pay occupiers tax taxe dhabitation or French property tax taxe foncière. Since 2019 a Pay-As-You-Earn PAYE system has been used universally throughout France.

Pay-as-you-earn tax in 2019. In May 2019 everyone will be obliged make a tax return on their 2018 income and although a full tax assessment will be carried out no tax will be. Together these taxes are the equivalent to UK Council Tax.

Since 2019 there are two rates that apply to the rental income of non-residents. The sum payable will be as advised on your income tax notice for 2018 on 2017 income. The planned measures will see an initial 30 reduction in your residential tax bill from November 2018.

It is payable by the individual who owns the property on the 1st January of the same year and is applicable whether you live in your property or rent it out. Consult prices in Paris and Ile-de-France for apartments and old houses.

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

Pin On Frugalfrance Com Best Of The Blog

What Is The Best European Real Estate Market In 2018 How To Buy In Spain Real Estate Marketing Real Estate Real Estate Prices

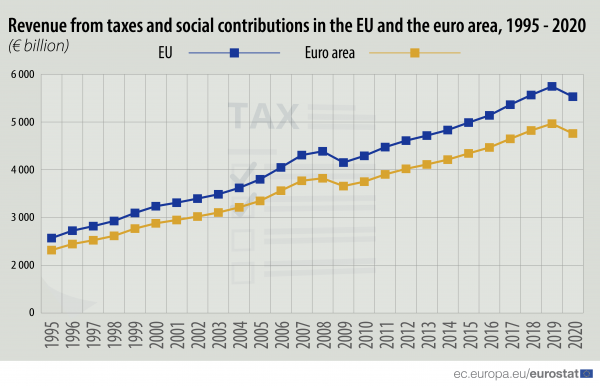

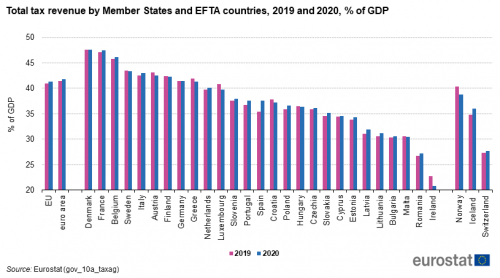

Tax Revenue Statistics Statistics Explained

Crypto News From Japan Jan 13 17 In Review Security Token Cryptocurrency Trading Chinese News

Investing Commercial Real Estate Real Estate Sales

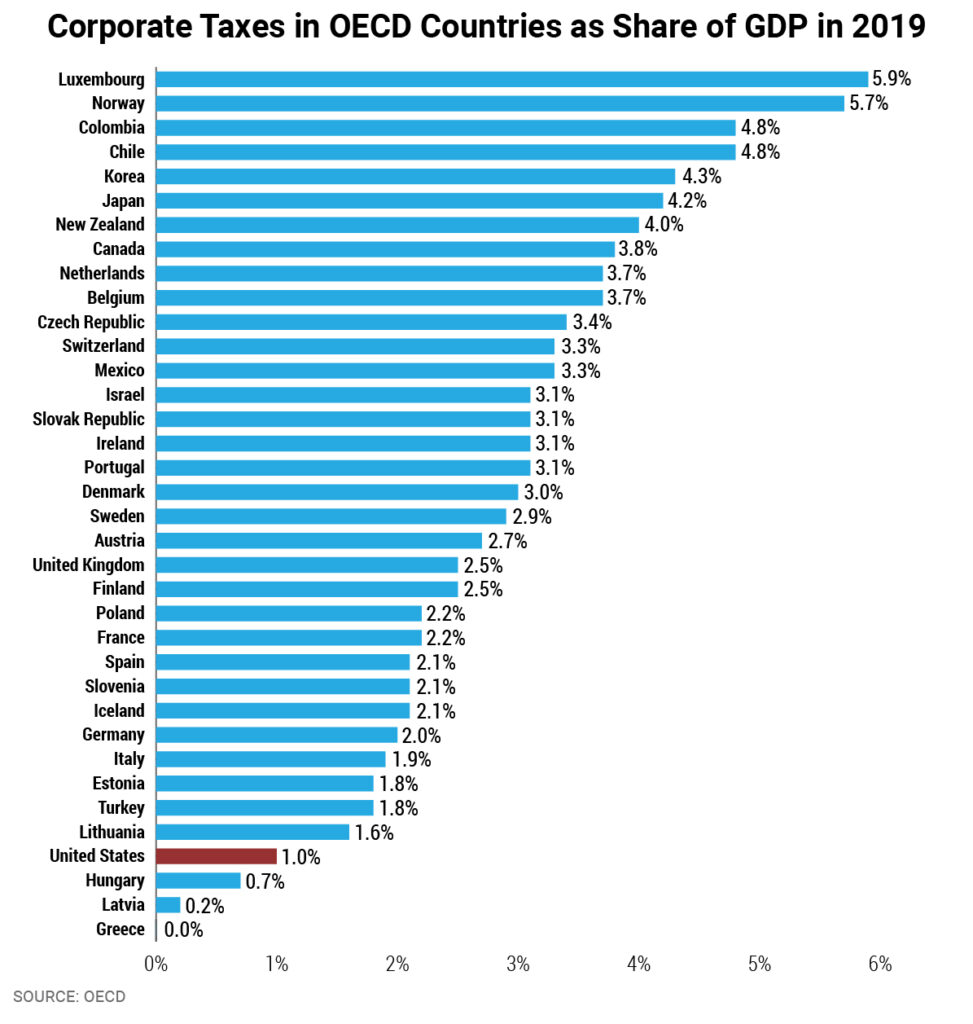

Corporate Tax Reform In The Wake Of The Pandemic Itep

Tax Revenue Statistics Statistics Explained

Chapman Taylor City Plaza Wins 2019 20 European Property Award Retail Architecture Wuppertal France City

What Is The Real Cost Of Buying A Property In Spain In 2022 Property Spain Property Buyers

Corporate Tax Reform In The Wake Of The Pandemic Itep

Get Ready With The Travel Genie To Start Planning Your Next Vacation On January 29 2019 In Celebration Of Na Travel And Leisure Corporate Travel Trip Planning

Taxes In France A Complete Guide For Expats Expatica

Expats And Taxes How The French Council Tax Affects Both

Our Infographics Motivation Famous Motivational Quotes Motivational Thoughts

Property Tax Cap Favours Nova Scotia S Wealthy Saltwire Property Tax Nova Scotia Property

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times